This blog post is part of a seven-part series reviewing the Acquisition Gateway and IT Category data, trends, expertise, and advocacy that GSA’s Office of Information Technology Category (ITC) organization offers to support other agencies’ missions.

(Note: This is a guest blog post by Amando E. Gavino Jr., Director, Office of Telecommunications Services. Gavino is responsible for a portfolio of telecommunication acquisition solutions that provide government agencies the ability to meet their diverse set of telecommunication requirements.)

ITC’s Office of Telecommunications Services provides a wide variety of offerings to federal, state and local governments which includes voice, video, data, managed network services, call center services, mobile and wireless, satellite services, last mile connections and much more. Because of our partnership with industry and our robust solution sets, we are able to provide government agencies seamless access and support, thus achieving shared value and expanding the benefits of modern technology. We’re continually transforming and enabling improvement to the security, safety, and quality of life for our nation and its citizens.

We enhance security by providing the communications services that connect law enforcement resources with information locally and worldwide to counter crime and terrorism. We also support the safety of our men and women in uniform, humanitarian relief, disaster-response, and counterterrorism efforts through satellites. And the telecommunications service we provide also improves government’s ability to respond anywhere and anytime through mobile devices (i.e., tablets and wireless smartphones); enhances patient health care for veterans and aging population; supports farmers and ranchers; tracks wildlife and diseases; and ensures food safety and inspections.

A Look Back at 2016

We’re always trying to improve, and here are a few ways:

Simplifying, Standardizing, and Buying in Volume

The Category Management (CM) approach to simplify, standardize, and make use of volume to streamline enterprise-wide telecom is the focus of Enterprise Infrastructure Solutions (EIS). CM helps us adapt our solutions as the industry changes and as agency needs change. For example, we’re being less local and more global to ensure agencies adopt security and unified communication technologies that comply with best practices.

Managing Telecom as a Subcategory

We are managing Telecom and all of our offerings in IT as a comprehensive portfolio and have technical, functional and acquisition experts to help agencies buy in a more efficient way and improve mission delivery.

Engaging Agencies and Industry

In 2016, GSA continued to engage agency and industry partners to shape the upcoming EIS, which will replace Networx and local and regional telecom services. We formed the EIS Infrastructure Advisory Group (IAG) to define priorities share best practices, plan for transition and ensure the final EIS solution meets government’s needs.

Optimizing Telecom Use and Spend

Because of our strong partnerships with agencies, GSA’s telecommunications program is recognized as “the government’s telecommunications program,” and as a result, we are able to aggregate and leverage more than $2 billion in annual spend and document over $675 million in savings.

Providing a Range of Purchasing Options

We recognize that ease of use is critical for our agency customers so we offer a range of purchasing solutions across our IT and telecommunications contracts — everything from self service through delegated procurement authority … to monitoring contract service level agreement achievement … to providing advice and consulting to providing fully assisted services.

Enhancing Agencies’ Understanding of Telecom Purchases

Telecom has been managed as a category for a while. Because of standard service definitions and contract terms in contracts like Networx, agencies can make “apples to apples” comparisons around services. This makes it easier for GSA and other agencies to make comparisons between suppliers and to get the best value for their purchases. And, because of the data we collect on purchasing, GSA can clearly see purchasing trends which shape future contracts (e.g., EIS, etc.) and our discussions with agencies and suppliers. We continually refine this data driven approach to supplier management to get better value for agencies and taxpayers.

Here is what we have seen over the past 10 years. Demand for bandwidth has increased at a compound annual growth rate that exceeds 30 percent, but our normalized costs for the bandwidth has decreased. Part of this is simply an industry phenomenon. Bandwidth is getting cheaper; however, part of this is due to our data driven approach to our interactions with suppliers. We expect bandwidth to be “cheaper by the dozen” and we have an approach to ensure this is the case. Further, most agencies are modernizing their networks through increased bandwidth demand, especially via Ethernet services. For instance, enterprise network services are migrating towards 10/100/1000 Mbps Ethernet; our Networx extensions focused on this migration and Ethernet is an EIS required service.

The increased demand for these services drove purchasing up 10 percent on Networx in 2016, which further lowers telecom costs, especially for Ethernet services. The availability, performance, and price of Ethernet services will remain important for years to come. In 2017 and beyond, EIS is on target to continue lowering costs for government.

2017 Telecom Priorities

Our biggest priority in 2017 is to continue to collaborate across government and industry, and begin the transition to EIS.

The EIS Transition Challenge Government-wide

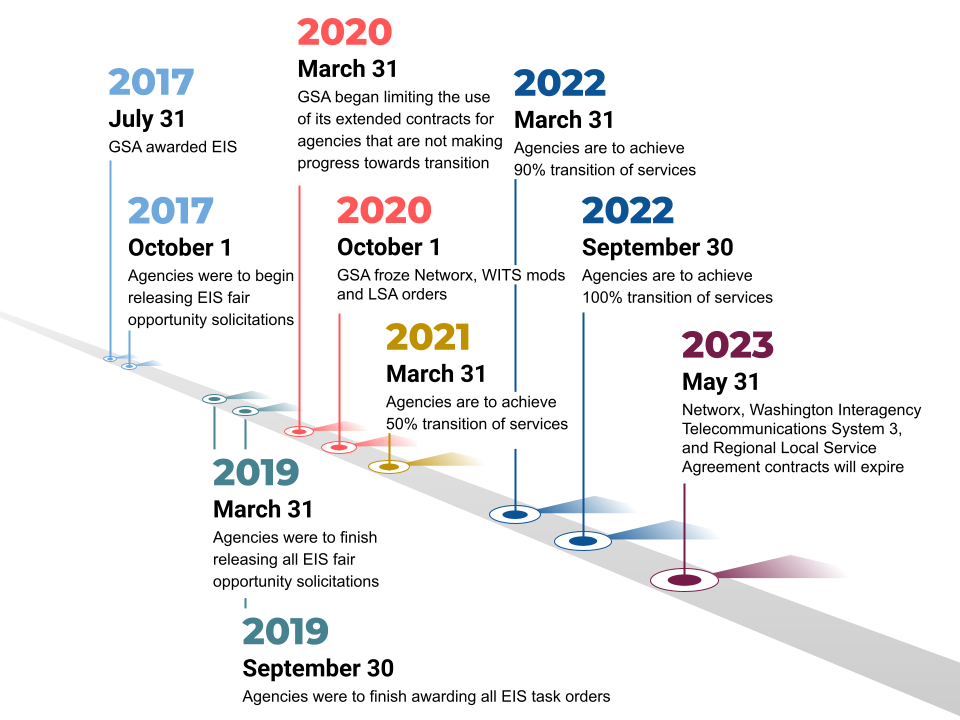

GSA and agency partners are preparing for the EIS awards so transition can begin and be completed by 2020. All agencies using Networx were required to submit Agency Transition Plans, which were due in fall 2016. We are excited to continue to work with industry and agency partners to take advantage of new solutions and new technology.

Mobility Savings and Enhanced Management

Mobile services are also in the spotlight in 2017. Five wireless service plans — three data and two voice plans — represent more than 90 percent of federal government’s purchases of mobile services. Standardized buying forces competition to focus on price and quality since many features and requirements are the same (Federal Strategic Sourcing Initiative-Wireless (FSSI-W) customers paid 26% less in 2016 than in 2012 because of this simple standardized strategy). In 2017, the government-wide Mobile Services Category Team (MSCT) will drive further savings as FSSI-W growth continues and the MSCT defines the next-generation mobility program.

Demands for Bandwidth, Security, and Satellites

Bandwidth demands and security capabilities will continue to grow in 2017, and we’ll also launch a new Commercial Satellite Custom Commercial SATCOM Solutions (CS3) contract.

In all these areas, we partner with agencies to find the best telecom infrastructure solutions to meet mission needs.

Learn More about Telecom Solutions

To find out more about available tools, best practices, and telecom solutions, select Telecommunications and Network Services on GSA’s website and visit the Telecommunications Hallway on the Acquisition Gateway.

Please follow ITC on Twitter @GSA_ITC and LinkedIn to join our ongoing conversations about government IT. Visit all the IT Hallways on the Acquisition Gateway for more information on the IT category and subcategories.