In my last post, we talked about GSA’s issuance of the Enterprise Infrastructure Solutions (EIS) Request for Proposal (RFP) on October 16, 2015. On the heels of this important milestone, GSA is announcing some changes in our Regional Network Services Program.

The Regional Network Services Program (RNSP) resides within the General Services Administration’s Office of Integrated Technology Services (ITS). The program provides telecommunications service delivery and technical support for federal agencies nationwide. (GSA services are available in all states and also in Puerto Rico, the Virgin Islands, Guam, Samoa, and the Northern Marianas Islands.)

The program’s FY2015 business volume exceeded $450M managing more than 80 Local Service Agreements (LSAs) or contracts with all major suppliers of telecommunication services, including the largest and most well-known of the LSAs–the WITS 3 Contract.

The Regional Program offers significant economic value to its customers by offering excellent–and in most cases, the best–prices available to government agencies.

The following table shows the average monthly prices for basic telephone service offered by the program in FY2016 and FY2011. As noted, average RNS Program prices have decreased, whereas prices in the broader U.S. economy have increased for business local telephone service. Prices in eight of 11 regions have decreased.

| Average Monthly Recurring Charge – Basic Telephone Line |

|||

|---|---|---|---|

| Region | FY2011 | FY2016 | CAGR* |

| 1 | $27.14 | $22.76 | -3.46% |

| 2 | $29.77 | $20.21 | -7.45% |

| 3 | $21.61 | $21.59 | -0.02% |

| 4 | $22.54 | $14.40 | -8.57% |

| 5 | $24.23 | $21.38 | -2.47% |

| 6 | $35.28 | $28.65 | -4.08% |

| 7 | $20.70 | $23.32 | 2.41% |

| 8 | $26.15 | $31.01 | 3.47% |

| 9 | $28.03 | $19.07 | -7.41% |

| 10 | $17.66 | $19.27 | 1.76% |

| 11 | $16.43 | $9.29 | -10.78% |

| Program Average (Regions 1-11)** |

$19.43 | $14.41 | -5.81% |

| Producer Price Index-Business Local Telephone Service*** |

$101.80 | $108.10 | 1.21% |

- * The compound annual growth rate (CAGR) provides a constant growth rate over a multi-year period.

- ** All averages are weighted averages.

- *** PPI – Business Local Service (Wired Telecommunication Carriers) is tallied by the Bureau of Labor Statistics (Product Code No. 517110-112).

Full-Service Delivery Model

The Regional Network Services Program supports a full-service delivery model in Regions 1-10, where GSA works solely with telecom service providers on behalf of its agency customers. (The WITS3 program in Region No. 11 is an exception; it is a “customer direct order” contract.)

Full-service delivery allows agencies to focus on their missions rather than manage the complexities and risks inherent in telecom/datacom procurement and operations.

Moreover, agencies derive significant imputed savings (stemming from federal agency cost avoidance) when opting for full-service, since GSA assumes responsibility for the following:

- Providing telecom requirements analysis and specification;

- Conducting acquisition and “fair opportunity” decisions;

- Placing service orders for moves, adds, and changes;

- Transitioning service from one service provider to another (where applicable);

- Assuring prompt payment to vendors;

- Reconciling monthly invoices with inventory; and

- Providing ongoing inventory management and vendor oversight.

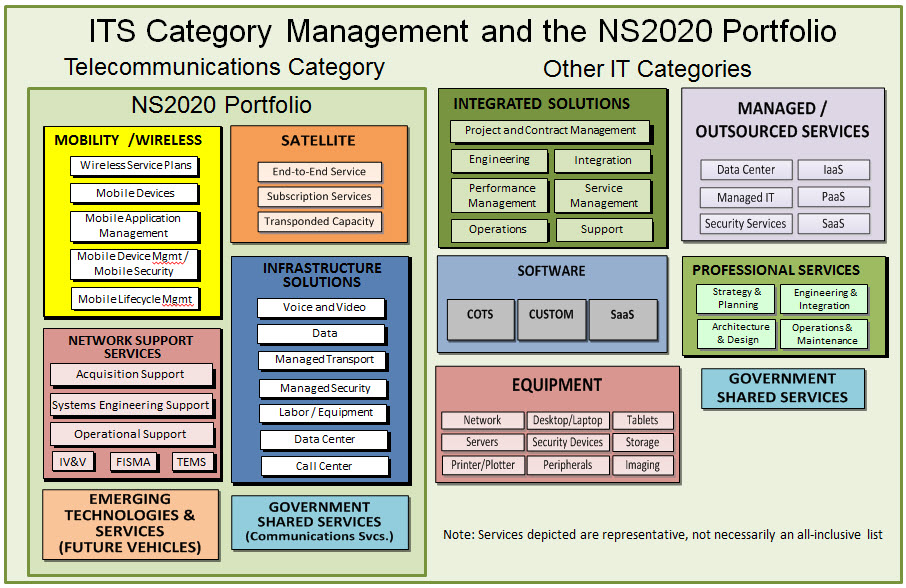

As part of the recent introduction of category management, the Regional Program has instituted a common, nationwide fee structure for its services in FY2016. Effective category management makes use of market intelligence and expert guidance in procuring goods and services in the telecommunications category. In addition, category management aims for pricing transparency and simplicity. The Regional Program has accordingly introduced a common program fee structure across all LSAs in Regions 1-10.

GSA is also pleased to announce the extension of the GSA National Capital Region’s WITS 3 Contract effective September 10, 2015 with the WITS 3 contract holders, Level 3 and Verizon. Under the extension, the contract Period of Performance consists of the following:

- A three (3) year base period (November 8, 2015 – November 7, 2018)

- A one (1) year option period (November 8, 2018 – November 7, 2019)

- A final option period (November 8, 2019 – May 30, 2020)

The follow-on contract to WITS 3 and the Regional LSAs is the Enterprise Infrastructure Solutions (EIS) Contract. GSA is focusing increasingly on transition planning from the Regional telecommunications contracts to EIS.

Agencies should also be working on transition plans. We look forward to collaborating with agencies for the transition to EIS.

If you haven’t already been in touch with us, please go to the EIS webpages and download the template for transition planning or contact your GSA Technology Service Manager.