You’ll recall my April post discussing Category Management and FAS’s launch of the Acquisition Gateway, a space for acquisition professionals to learn, connect, and act upon acquisition information, expertise, and advice. It will serve as an important tool to support and improve how the federal community acquires products and services.

When I wrote that post, ITS had successfully launched the IT Hardware and IT Software category hallways. We’ve since launched three more:

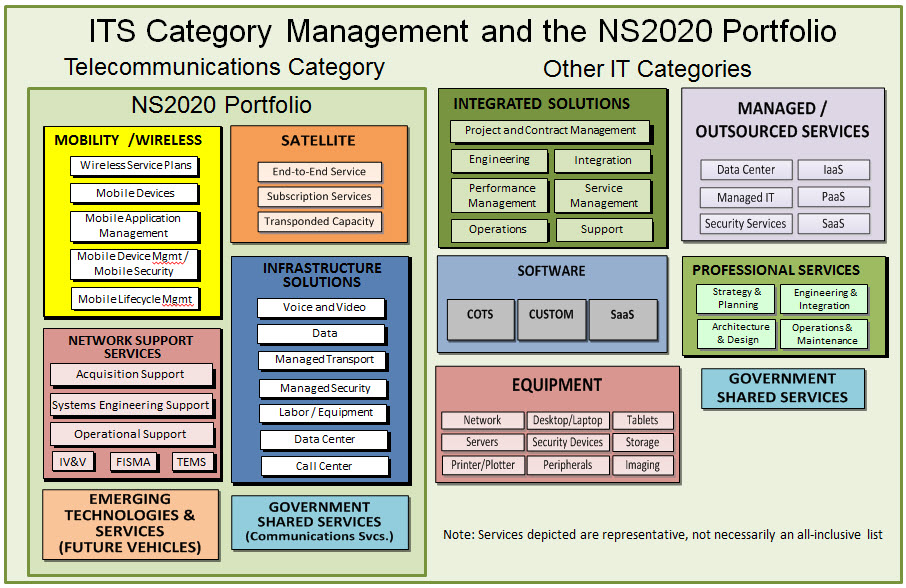

- Telecommunications,

- IT Services, and

- IT Security.

Now the Acquisition Gateway has 17 category hallways, all of which fall into one of the 10 civilian-centric categories, which account for 80 percent of total federal spend.

With collaboration and support from our partner agencies, our IT category managers have collected pricing tools and information, guides, best practices, and expert articles that will help acquisition professionals make more efficient IT procurements.

Agile development process

The Acquisition Gateway is based on an agile development process, where software developers prototype early and iterate often, continuously focusing on end-users and the tasks they need to accomplish.

In this case, the development team involves all end-users in a transparent and collaborative development process. Success requires constant collaboration and a continuous process of incorporating user feedback, including customer-contributed expertise and content.

If you’ve visited the Acquisition Gateway in the past few months, you may have noticed new system changes and enhanced services, including:

- Revamped Homepage – more easily accessible sections

- Solutions Finder – revamped the solutions matrix to make searching governmentwide-available solutions easier

- Communities – a place to connect with acquisition professionals and share knowledge

- Project Center where users can build an acquisition, complete with project details

- eBuy Open – an interactive web application that displays eBuy RFQ information to users and provides several filtering and search options, which enables users to quickly drill down to desired information

- TechFAR Hub – a community of practice open to all federal government employees with an interest in successful acquisitions. The TechFAR Hub and the Gateway share the common goals of saving taxpayer dollars, making acquisition more efficient, and improving service to customers inside government and out

- Prices Paid Portal – an interactive web application that provides users access to selected data sets which can be searched, filtered, and exported

- Shared Services – A hub to help federal departments and agencies find and leverage existing solutions rather than build new ones

Acquisition professionals and IT experts like you made these enhancements possible.

Over time, category hallways will capture the expertise of users, category managers, and industry experts and will become a more powerful and effective tool as users from across government share content, contract solutions, data, and industry expertise. Currently, only federal government users have access to the Acquisition Gateway.

However, because transparency is important, GSA is creating a public view of the Acquisition Gateway planned for early FY16. The Public view will be available to stakeholders such as industry, state and local government, and citizens.

When it comes to IT acquisition, having a single place to gather market research, connect with experts, and complete data-driven acquisition confidently and efficiently is invaluable. The Acquisition Gateway enables more efficient procurements by leveraging contract intelligence and spending data to facilitate smarter purchasing.

We are looking forward to implementing the following enhancements soon:

- Launch a Statement of Work (SOW) library across multiple categories (currently resides in the Professional Services category hallway)

- Integration of Advantage Select which establishes FAR compliant, pre-competed, “click-and-pay”, contractual vehicles that any Government buyer can use. Advantage Select will enable more competition, more often, on the most commonly purchased commodity items, and then showcases and gives transparency of these products and pricing to the entire Government acquisition/contracting enterprise for the ultimate experience in low cost, streamlined purchasing.

Get Started

To continue building on what we’ve already accomplished together over the past year, please go to the Acquisition Gateway and share your feedback with us. We need acquisition experts in all government agencies to share their knowledge.

So how can you start?

- Sign up for an OMB Max account and login to the Acquisition Gateway

- Tell your co-workers

- Share your best practices, templates, and expertise

- Participate in the communities

- Share your prices paid / transactional data

- Provide information on acquisition solutions

- Join us for usability testing to help drive new features. If you are interested in participating in Acquisition Gateway usability testing, please contact Kelly Robinson at kelly.robinson@gsa.gov

For more information or to get involved, please email natasha.sheehan@gsa.gov. Follow us on Twitter @GSA_ITS to join GSA’s ITS’s overall acquisition conversations.