(This blog post is part of a multi-week series reviewing data and trends from GSA’s IT acquisition vehicles for FY15. Read previous posts at http://gsablogs.gsa.gov/technology/)

Schedule 70 is growing again!

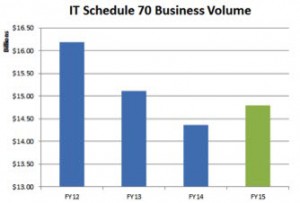

IT Schedule 70 continues to be the largest, most widely used acquisition vehicle in the federal government. In FY15, the program started growing again, bouncing back after a downturn in business volume in prior years.

IT Schedule 70 provides federal agencies with direct access to more than 4,700 pre-vetted innovative companies, who provide high-quality IT products, services and solutions.

In FY15, federal agencies bought more IT products and services through IT Schedule 70 than in the previous fiscal year, growing the program’s business volume by 3% ($424M) to a total of $14.8 billion.

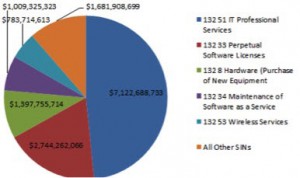

In addition, federal agencies spent the majority of their IT procurement dollars through three Special Item Numbers (SIN) on IT Schedule 70 in FY15:

- IT Professional Services,

- Perpetual Software Licenses, and

- Hardware, making up over 75% of business volume.

We expect further growth in business volume in FY16 as a result of our many initiatives to increase value of the program. Examples are: the Cloud SIN, the Cyber Security/Information Assurance Project(Cyber IA), the upcoming Health IT SIN, and our recent FITARA initiatives with Salesforce and Esri.

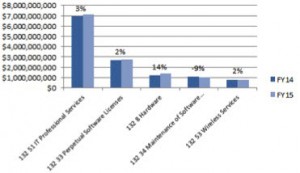

Hardware and IT Services lead the pack in year-over-year growth

In FY15, the Hardware SINs topped the list in year-over-year growth with a 14% jump from $1.6 billion to $1.74 billion over FY14. IT professional services posted the largest real dollar growth of $211 million. IT professional services remain the majority of the IT Schedule 70’s business volume.

Year-Over-Year Growth for Top Five SINs

There is also more good news ahead for hardware business volume in IT Schedule 70.

OMB recently selected IT Schedule 70 (PDF, 4,120 KB) to be one of three federal contract vehicles tapped to participate in the Government-wide Strategic Solutions for Laptops/Desktops. The initiative’s goal is to develop a framework and strategic approach to buying from specific government-wide contracts with standardized configurations, and bring transparency into terms and conditions and pricing, all aimed at helping federal agencies get better value for their laptop and desktop dollars.

We continued to help more companies succeed

No analysis of business volume would be complete without reviewing how our Schedule 70 partner companies are using the contract. We want Schedule 70 to be an effective tool for both the government buyer and the private sector.

In May 2015, we established a tiger team to work with IT Schedule 70 business partners who were not meeting minimum sales requirements. “No sale” or non-productive contracts result in an administrative cost to the government. And we know that companies expend effort and resources to obtain and maintain a Schedule contract in the first place so we want Schedule 70 to be of great value to our partners as well.

As a result, all IT Schedule 70 contracts contain a clause requiring vendors to generate $25,000 in sales in the first two years of the contract and $25,000 each year afterwards. This clause exists to make sure business partners are productive on their contracts.

In all, we identified and worked with over 200 business partners to become productive, reducing the administrative costs of their contracts in the process, while helping them to be more successful in the federal market.

The now-productive business partners either made the necessary sales, developed a comprehensive marketing plan, or hired personnel to support their business development efforts.

Ultimately, we are committed to supporting our business partners toward meeting their contract sales requirements. We will do all we can to help them succeed in the federal market.

That’s a wrap!

Well, that’s the IT Schedule 70 FY15 business volume data story:

- IT Schedule 70’s business volume grew by 3% ($424 M) to $14.8 billion;

- Hardware and IT Services saw the largest growth in business volume; and

- We helped over 200 business partners stay compliant with their sales requirements.

FY15 was a great year for IT Schedule 70, and FY16 promises to be even more successful.

For more news and updates about IT schedule 70 and other GSA ITS programs, please follow us on Twitter @GSA_ITS and join the conversation.